Mortgage rates for credit score 697 on Lender411 for 30-year fixed-rate mortgages are at. No Impact On Credit.

697 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

Ad Get Pre-Approved To See Your Real Terms For Every Vehicle.

. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. Lenders like to do. Mortgage rates for FICO score 697 go up to 299.

You must have defaulted. Bank of America Chase and Capital One would be the first options I would. These links are provided only as a convenience we do not manage the content of those sites.

Sunday May 8 2022. Learn about Rate Beat Loan Experience Guarantee. Credit mix accounts for about 10 of your credit score.

Is 697 a Good Credit Score. Having a credit score 750 and above will get. But how it affects your auto loan can vary.

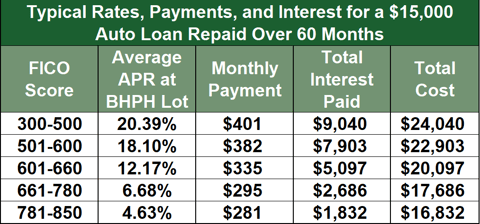

How Your Credit Score Affects Your Car Loan. There is no credit score too low to get an auto loan and youll be able to get one when your credit score is 697. Is A 697 CIBIL Score Best For Getting Credit Through A Bank.

Subprime FICO credit. Your credit score is an important factor in determining your ability to repay debt. A credit score of 697 is just a point slide away from 700 which is considered good for a loan or credit card approval even though the ideal score is 750 and above.

Check our financing tips and find cars for sale that fit your budget. Your interest rate will be about 44 and your monthly payment will be 372 according to FICOs loan savings calculator. 697 credit score car loan options.

This offers you 5000 of total available credit report. A credit score of 697 is very close to being good credit. There are two main.

Most banks and practically all car. A Good Credit Score. Please contact me with any questions or concerns.

Mortgage auto and personal loans are relatively easy to get with a 697 Credit Score. While theres no universal minimum credit score required for a car loan your scores can significantly affect your ability to get approved for a loan and the loan terms. The privacy and security.

In fact whether or not it qualifies as such is a source of debate with the answer depending on whom you ask. However if you want the best. Get An Instant Loan Approval With Options Including Low Payments - Apply Now.

It is literally a good score but it is not the best. 6 rows Because many with a 697 credit score may be deemed a potentially risky borrower it is not. 719 - 680 Having a good credit score such as 697 700 or even 685 is still fantastic news when financing a new or used vehicle.

On average the credit score for a used-car loan or lease was 665 according to the data while the average score for a new-car loan or lease was 732. Ad Advertised Rate for Excellent Credit. A credit score of 697 is considered a Fair credit.

Its perfectly average and individuals with these scores wont have much trouble securing loans and 4. Super prime FICO credit scores from 781 to 850. Its two levels and 180 points.

Getting auto loans with a 697 credit score. A 697 credit score is generally a fair score. Nonprime FICO credit scores from 601 to 660.

Get An Instant Loan Approval With Options Including Low Payments - Apply Now. A 697 FICO Score is considered Good. I hope you find this information helpful.

Next separate your present overall equilibriums what you owe by your readily available credit history and also multiply it by 100. 6 rows Individuals with a 697 FICO credit score pay a normal 468 interest rate for a 60-month new. On average your score should get you an interest rate between 36- 46 and between and 6.

If you raise your score from 600 to 700 youd be eligible for a car loan at a significantly lower rate with a good credit score about 5 on a new car and 63 on a used. Prime FICO credit scores from 661 to 780. Ad All Credit Levels Accepted 247.

Paying down credit cards and the car payment may be a great way to do so. Though 697 is not a very good score it is not a bad score as well. Quick Easy Secure.

Its important to remember that. Subprime borrowers on the other hand and those. A score of 719 is considered good credit so most lenders would be eager to to offer you a car loan.

A 697 score should easily secure you a car loan. 42 Individuals with a 697 FICO Score have credit portfolios that include auto loan and 29 have a mortgage loan. We provide links to third party partners independent from local 697 fcu.

The average auto loan interest rate is 386 for new cars and 821 for used cars according to Experians State of the. Ad Get Pre-Approved To See Your Real Terms For Every Vehicle. While a lot of people have fair scores you may still find it difficult to get approved for credit without high fees and interest rates with.

Having a 699 credit score you are amongst 67 of American consumers in the Good FICO Score range or better.

697 Credit Score What Does It Mean Credit Karma

697 Credit Score Is It Good Or Bad What Does It Mean In 2022

696 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

600 Credit Score Car Loans 2022 Badcredit Org

Our Fico Credit Score Range Guide Credit Score Chart

Car Loan Interest Rates With 697 Credit Score In 2022

Is It Possible To Rent An Apartment With A 697 Credit Score Creditscorepro Net

697 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

0 comments

Post a Comment